The Carbon Certification Process

- WaKa Brasil

- Oct 18, 2023

- 3 min read

In this text, we will delve deeper into the steps necessary to certify a carbon sequestration project in the voluntary market. We must emphasize that this process is different for each certifier, with some steps in common between them.

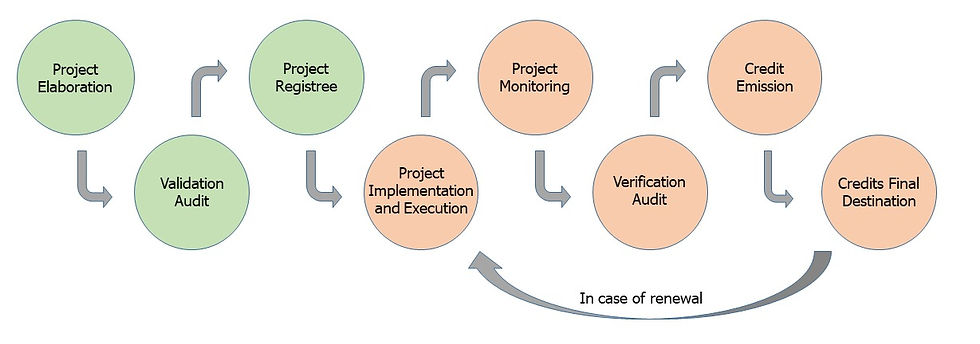

Each certifier has a series of requirements for project registration, which are generally linked to the type of activity executed for removal or reduction, called methodology. After choosing the methodology and preparing the project, an independent audition happens, where is analyzed whether the project meets the requirements. After this initial approval, registration is carried out and the time for issuing credits, or period for crediting, begins to count.

During this period, continuous monitoring of the project must happen, which will be presented to the certifier through reports, where scenarios with and without the project are also analyzed to assess the need for adjustments. A second audit also takes place during the crediting period to check the progress of the project. Only after all these steps have been correctly completed, carbon credits are ready to be sold. This is just a summary of the process, which may include other audits or corrections as it progresses.

Adapted from ICC Brasil e WayCarbon. Oportunidades para o Brasil em Mercados de Carbono. Relatório 2022. * The processes that only need to happen once are represented in green while the processes that must be repeated in project renewal are represented in orange.

Despite the different requirement to carbon credits emission, there are some general characteristics that the projects must present, which are addressed in different ways by the certifiers. The reductions and removals must be:

Real and measurable: The projection of the amount of carbon sequestered must be calculated in the project, with some indicators being attributed where is possible to verify whether the sequestration or reduction is actually happening.

Additional: The proponent must demonstrate that there would be no carbon reduction or removal without the incentive of carbon credits revenue.

Permanent: Refers to the longevity of the actions executed in the project and the risks of reversal, which may or may not be intentional.

Unique: Project area cannot present double counting, that is, it can only present a single certification.

If risks are found that allow deviations from some of these characteristics, such as permanence, they must be mentioned in the project, as well as analyzed, mitigated, monitored and included in the reports. Some possible deviations may be included as credit discounts at the end of the crediting period, such as leakage fees, where is considered that the avoided emission may be occurring elsewhere. There are also standards that combined with certification increase the final value of the carbon credit. These standards are generally associated with the project’s socio-environmental factors and function as a way of guaranteeing the quality of the credits, at the same time that presents social benefits that go beyond carbon mitigation.

For those who want to enter their property into the carbon market, the questions are generally about cost-benefit. The costs of participating in certification programs involve project registration and credit issuance fees, independent audit fees, and the environmental consultancy responsible for preparing the project and monitoring reports. Scale influences some of this costs, since some rates are fixed and others are not, and the number of credits are greater in larger areas. The minimum time for issuing credits is 5 to 10 years, depending of the certifier. Partnerships can also be formed between landowners who wish to combine their properties into just one project, sharing the costs and final income.

References:

CCB Standards, 2017. Climate, Community & Biodiversity Standards: Third Edition. VCS. Disponível em: https://verra.org/wp-content/uploads/CCB-Standards-v3.1_ENG.pdf

ICC Brasil e WayCarbon, 2022. Oportunidades para o Brasil em Mercados de Carbono. Relatório 2022. ICC Brasil e WayCarbon.

Vargas, D. B.; Delazeri, L. M. M.; Ferreira, V. H. P., 2022. Mercado de Carbono Voluntário no Brasil: Na Realidade e na Prática. Observatório da Bioeconomia. FGV EESP.

Comments